tax topic 201 - the collection process

201 The Collection Process If you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe. It says that if you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe.

The length of the process depends on how soon you respond and pay the bill.

. Rn If you have to have to get skilled aid for an economical selling price and are searching for low-cost paper writersrn our organization is what you require. This bill begins the collection process. Topic 201 - The Collection Process.

The first bill you receive will explain the reason for your balance due and demand payment in full. If you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe. For example when the time or period for collection expires.

Pin By Lindsay Middleton On Hair Federal Agencies Income Tax Income. Filing a Notice of Federal Tax Lien. Jump to Sections of this page.

If you dont pay your tax in full when you file your tax return youll receive. Tax topic 201 - the collection process. 201 The Collection Process If you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe.

The notice that is first get should be a letter which explains the balance due and needs repayment in complete. This bill starts the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax. If you do not pay in full when you file you will receive a bill.

It could help you navigate your way through the IRS. Tele-Tax Topic 201 If you do not pay in full when you file you will receive a bill. We can handle practically any deadline and do not want you to invest a fortunern on crafting help.

The IRS will automatically apply any prior years balance due to current refund. View our interactive tax map to see where you are in the tax process. If you go Topic No.

If you are member associated with the Armed Forces you might be in a position to defer re payment. See Publication 3 Military Tax Guide. For example when the time or period for collection expires.

For extra information on presently perhaps perhaps perhaps perhaps not collectible make reference to Topic No. If you do not take some action to pay your tax bill or contact us to make arrangements to settle the account we may take enforced collection actions to secure payment. 201 The Collection Process.

It will include the tax due plus penalties and interest that we have charged on your unpaid balance from the date your taxes were due. This bill begins the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax for example if the collection period has expired. 201 The Collection Process.

Par jck Nov 16 2021 blog 0 commentaires. Read the Tax Topic. The first bill you receive will explain the reason for your balance due and demand payment in full.

Tax Topic 201 means that you owe tax to the IRS. If you do not pay in full when you file you will receive a bill. Tax Topic 201 - The Collection Process.

It is important to contact IRS and make arrangements to pay the tax due voluntarily. You do not need to do anything different when you filed or notify them. If you have questions or need additional information please have the following on hand when you call.

This bill begins the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax for example if the collection period has expired. The first notice you receive will be a bill explaining the balance due and requiring. It will include the tax due plus penalties and interest that are added to your unpaid balance from the date your taxes were due.

Tax Topic 201 The Collection Process. LITCs can represent taxpayers in audits appeals and tax collection disputes before the IRS and in court. More In Help You file your tax return youll receive a bill for the amount you owe if you.

Tax Topic 201 explains the collection process for income tax due. This bill begins the collection process. 201 The Collection Process on irsgov.

You need to call us and then make plans to cover the income tax due voluntarily. This bill starts the collection process which continues until your account is satisfied or until the IRS may no longer legally collect the tax. Tax Topic 201 - The Collection Process What do I need to do if I see this applied to my refund.

A copy of this pageA copy of your tax returnThe Social Security Number Filing Status and refund amount claimed on your returnAny notice that you have received concerning your refund. Some of the actions we may take to collect taxes include. How To Decorate Project Files With Cover Page And Border Cover Page Decoration Youtube Scrapbook Cover Page Decoration Folder Cover Design.

Pin By Lindsay Middleton On Hair Federal Agencies Income Tax Income

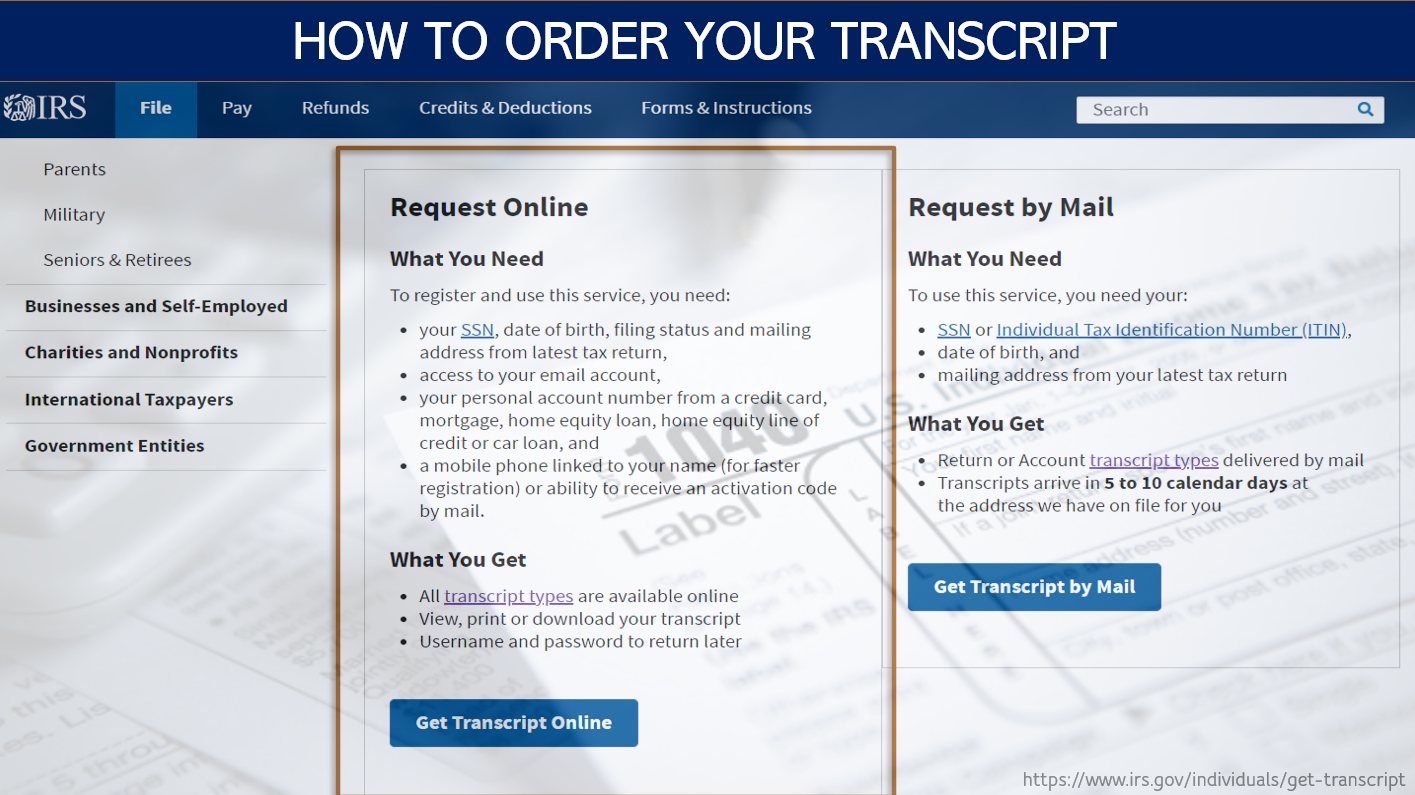

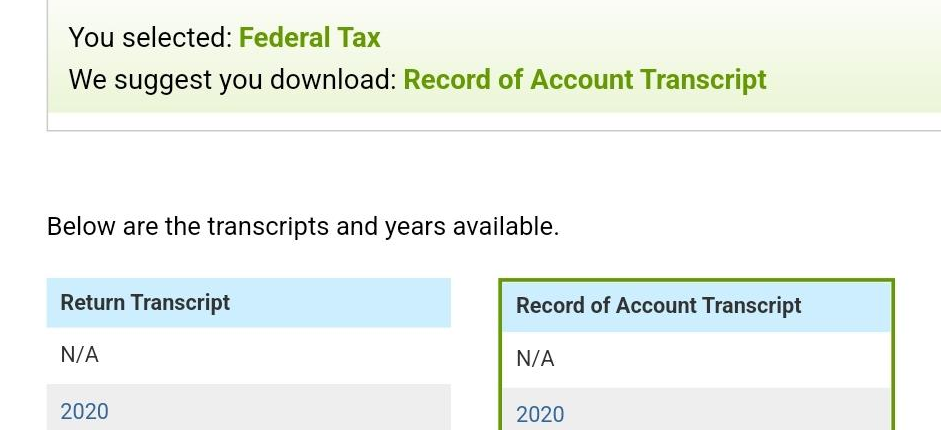

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Like Kind Exchanges Of Real Property Journal Of Accountancy

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

How To Maximize Tax Write Offs For Therapists

Policy Basics Tax Exemptions Deductions And Credits Center On Budget And Policy Priorities

Arizona Tax Research Association The Taxpayer S Watchdog Since 1940

Tax Refund Offsets Where S My Refund Tax News Information

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Irs Where S My Refund Refund Status Reference Error Codes

What Happens After You Report Tax Identity Theft To The Irs H R Block

Your Federal Income Tax For Individuals Irs Publication 17 2021 U S Government Bookstore

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Effectively Representing Your Client Before The Irs 8th Edition